What is ICE and Why is it Important?

June 12th, 2024

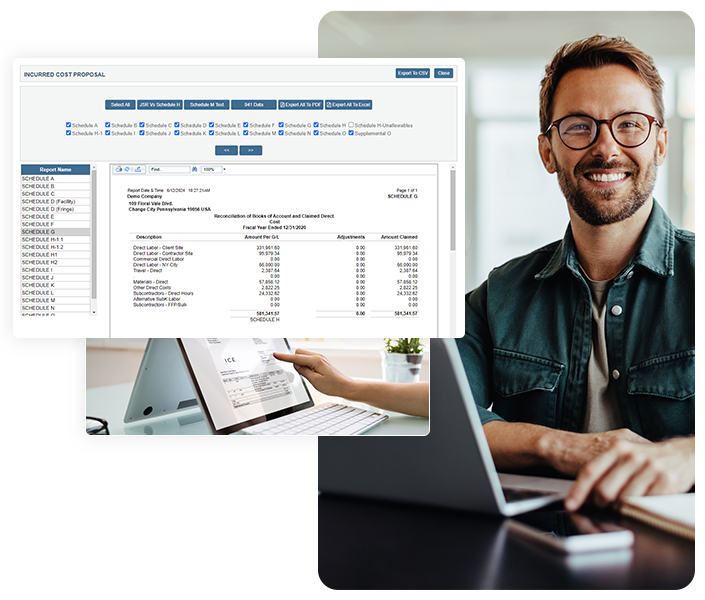

ICE, or Incurred Cost Submission, is mandatory for federal cost-reimbursable or T&M contracts. These submissions reconcile provisional indirect rates with actual costs, ensuring accurate reimbursement and compliance with Federal Acquisition Regulations (FAR).

Requirements for Submitting ICE

Incurred Cost Submissions (ICE) are crucial for government contractors with cost-type or time-and-material (T&M) contracts. WrkPlan simplifies ICE, ensuring timely and accurate submissions that meet all requirements.

- Schedule A: Summary of indirect expense rates.

- Schedules B-E: Indirect cost pools and base components.

- Schedule H/H-1/Summary H: Direct costs by contract.

- Schedule I: Cumulative cost incurred and billing reconciliation.

- Supplemental Schedules: Additional financial data and compliance information.

Challenges with ICE

- Adequacy Reviews: Ensuring completeness and correct formatting.

- Unallowable Costs: Identifying and excluding non-compliant costs.

- Record-Keeping: Maintaining precise cost records.

- Timing: Avoiding delays that affect cash flow.

For more information, visit WrkPlan Features or call – (866) 826-3399.